Canada

Highlight Reel

You’re in the big leagues now, and your benefits show it. At FanDuel, we’re proud to provide you with a VIP benefits experience. Your benefits go above and beyond, providing you with extended health coverage, retirement savings, wellness tools, and more. Enjoy the perks of being a pro!

Extended Health Care

It feels good to be a pro! FanDuel pays the full cost of extended health insurance through Sun Life for you and your eligible family members, including your spouse, civil or domestic partner, unmarried children up to age 21, and unmarried children up to age 25 who are students.

However, we can’t enrol you on your own. To get extended health coverage for yourself and your dependants, you must opt in. And here’s where the “extended” part comes in: to qualify, you must be enrolled in a provincial or federal plan. Residents of Ontario must be enrolled in provincial cover to qualify.

Extended health care includes expansive prescription drug coverage, emergency and hospital expenses, referred care, and much more. Explore the Sun Life Benefits Booklet for all the details.

To enrol, email the FanDuel Benefits Team and request enrollment information.

Emergency Travel Assistance

Whether you’re traveling for a game, for work, or for pleasure, Sun Life Emergency Travel Assistance gives you peace of mind. As long as you enrol in extended health insurance, you have robust medical cover when you’re traveling outside your province.

Sun Life covers emergency services while you’re traveling up to the maximum allowed by your extended health plan. Additionally, they can help you locate doctors and prescriptions in non-emergencies, assist with lost luggage or identification documents, advance you cash, and more.

When you enrol in extended health cover, you’ll also receive a travel card with contact information on the back for Sun Life. Put this in your wallet before you go bon voyage!

Dental

Calling all hockey players! Dental cover through Sun Life protects your teeth from normal plaque and flying pucks alike.

For your dental cover to kick in, you only need to meet a low deductible. Then, you’ll pay a percentage cost of your care up to an annual maximum (or, for some services, a lifetime maximum).

Family: $100

($4,000 annual maximum per person)

($4,000 annual maximum per person)

($4,000 lifetime maximum per person; under age 19 only)

Health Spending Account

Would you ever say no to free money? When you enrol in extended health insurance, you also receive $2,500 in credits in a health spending account. You can use those credits on eligible health expenses.

The federal government determines which expenses are eligible. Here are some examples:

- The portion of your medical and dental expenses not covered by your insurance

- Prescription drugs

- Medical supplies and devices

- Vision care

- Diagnostic procedures

- Hospital care

Long-Term Disability

Your long-term disability insurance protects your income if you become ill or injured and cannot work.

You’re automatically covered for 75% of your income, up to a maximum of $5,000 per month. Additional coverage is available for you to purchase in $500 increments, up to a maximum of $10,000 per month, as long as you provide Sun Life with proof of your good health. Benefit payments are reduced by any amount you receive through government-sponsored disability plans, workers’ compensation, or other insurance coverage.

Life and AD&D Insurance

Death is a difficult, but important, subject when you’re thinking about your family’s financial security. If something serious happens to you, your life and accidental death and dismemberment (AD&D) insurance kicks in and protects your loved ones. It pays a lump sum to your beneficiary in the event of your death or serious injury.

Your life insurance benefit is equal to two times your annual basic earnings, rounded to the nearest $1,000. You’re automatically covered for a minimum of $100,000; additional life insurance cover is available in $25,000 increments up to a maximum of $500,000. Proof of your good health is required for any coverage above $150,000. Dependant life insurance is also included for your spouse ($20,000) and children ($10,000 per child).

AD&D insurance is included in the same amount as your life insurance benefit. The amount of the payable benefit varies by injury severity and accident.

Mental Health

Professional Counseling

Kindbridge provides professional mental health support for a variety of concerns, especially those related to high-stress environments and impulse-related challenges. The experts at Kindbridge diagnose conditions, build a treatment plan, and coordinate with your FanDuel medical plan—and it’s all 100% confidential.

Use your five free counselling sessions for support with:

- Anxiety, depression, stress, or grief

- Gambling, gaming, or digital overuse concerns

- Relationship or family issues

- Work-related pressure or burnout

- Life transitions and personal challenges

- Any emotional or behavioural health concern on your mind

To get started, contact Kindbridge at 1-888-330-0245.

Employee Assistance Program (EAP)

Sometimes, the crowd noise is too loud. The EAP through Lumino Health is available to talk you through major and minor life issues—and provide extra support when needed.

The EAP offers virtual counseling to help you overcome whatever is on your mind. This service is 100% paid by FanDuel for you and your family members, up to four sessions per issue per year. When you use the EAP for mental health support, remember that your extended health insurance also covers visits with mental health professionals.

Use the EAP for support with:

- Anxiety, depression, stress, or grief

- Legal matters

- Financial concerns

- Career conversations

- Work conflicts

- Family issues

- Anything else on your mind

To use the EAP, download the Lumino Health app on the App Store or Google Play.

Whole Health Support

Your body and mind are connected. Going through a physical health problem takes a toll on your mental health, and vice versa. Goodpath is designed to help you treat symptoms and underlying causes of chronic health issues so that you can feel better.

Goodpath is equipped to manage and treat a variety of conditions, including:

- Musculoskeletal care for back, neck, hip, knee, shoulder, and joint pain

- Mental health

- Digestive issues

- Difficulty sleeping and insomnia

- Cancer survivorship

Sign up for a personalized care plan today.

Pregnancy and Parenting Support

Ovia Health provides support through every stage of life—whether you’re planning a family, navigating pregnancy, balancing work and parenting, or managing menopause. With expert guidance and one-on-one support, Ovia is there to help you feel informed and supported along the way.

Here’s what to expect:

- On-demand, unlimited health coaching

- Concierge one-on-one support from family health experts

- Personalized guidance and milestone tracking

To get started, download the Ovia app, and complete the registration process. Once registered, enter FanDuel as your employer, and select I have Ovia Health as a benefit to access Ovia’s premium features.

Retirement Savings Plan

Your retirement party is already underway, no matter how close or far from retirement you are. You have a Registered Retirement Savings Plan (RRSP) administered by Sun Life.

An RRSP allows you to contribute a fixed percentage of your salary to a retirement account. Then, up to a percentage of your salary, FanDuel matches your contributions. When you retire, you’ll receive your RRSP balance—your contributions, FanDuel’s contributions, and the investment gains in your account—as a lump sum. Under some circumstances, you can withdraw contributions from your RRSP before retirement, but you should consult with a financial advisor before doing that.

Sun Life manages your RRSP and invests contributions in a target-date fund based on your expected retirement date. But, if you prefer, you can take a hands-on approach to your RRSP and select your investments yourself.

Sun Life has plenty of tools on their website to help you plan your retirement, select a beneficiary, and more. You can also download the Sun Life app on the App Store or Google Play.

Financial Well-Being

Money is complicated. Don’t feel like you’re supposed to automatically know the right way to manage your today money, your just-in-case money, and your retirement money. It takes research and practice. nudge is here to help.

A comprehensive financial resources library, nudge demystifies the confusing world of personal finance. Once you answer a few questions about your situation, nudge develops a financial education plan for you. Use it to get your savings on track, manage your debt, or plan for retirement.

Your membership to nudge is 100% covered by FanDuel. Sign up on the nudge website.

Fitness and Wellness

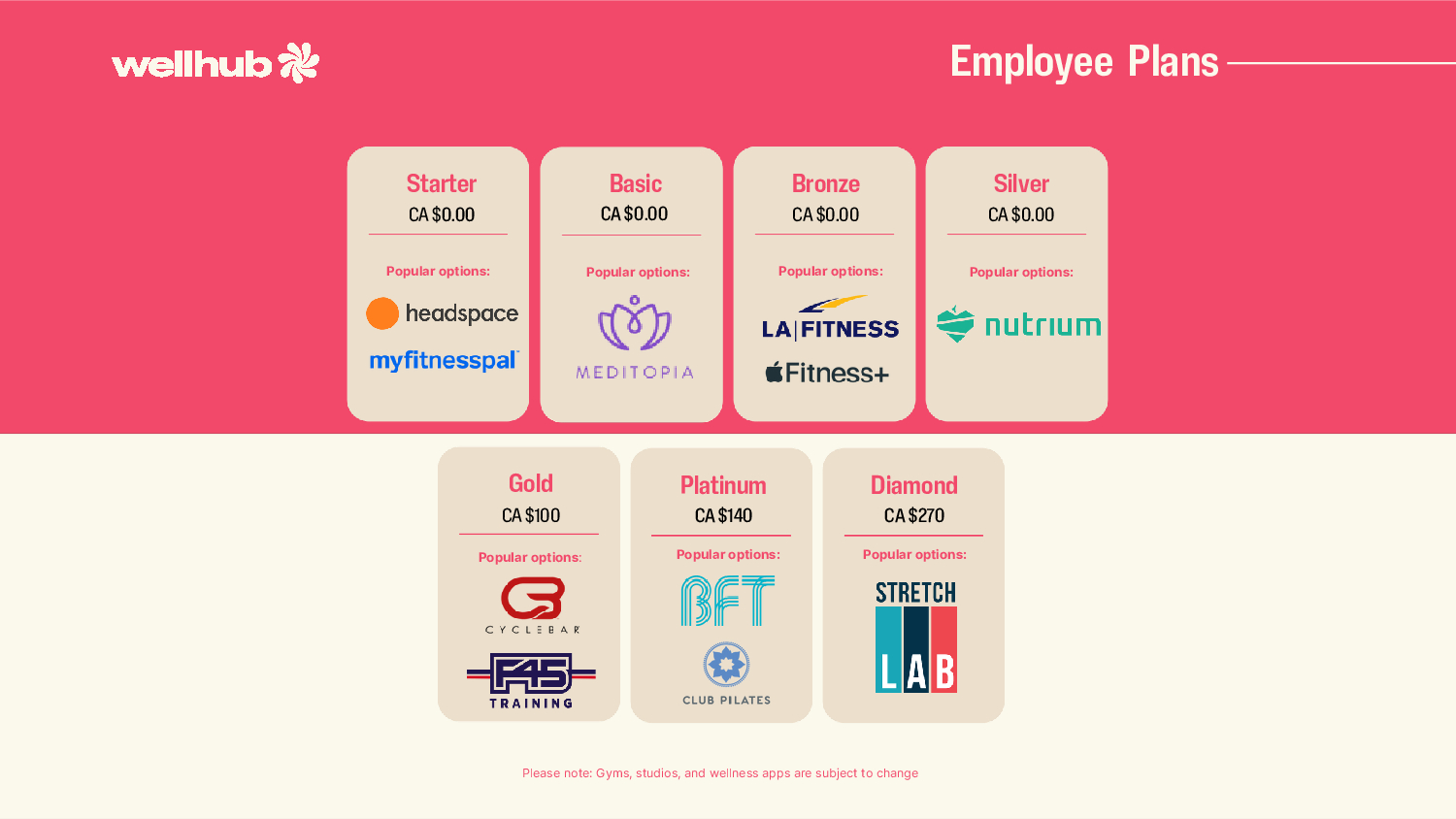

We’ve got your fitness membership covered. You have access to Wellhub, a valuable benefit to help you stay active and energized.

Your Wellhub membership is divided into tiers; the tier you sign up for determines which locations and brands you can access. FanDuel pays 100% of the tab for Silver-tier access and below. If you decide to spring for a higher membership tier, you’ll still get a discounted rate as a FanDuel employee.

To get started, download the Wellhub app, and register with your FanDuel email. Keep in mind that Wellhub subscriptions, at all tiers, are a taxable benefit.

Benefits for Your Mascot

Sign up for Airvet to get round-the-clock veterinary care for your pets at home, at no cost to you. Airvet is perfect for nonurgent concerns, like allergies or behavior issues, that would normally mean paying for a trip to your regular vet.

Some big highlights include:

- 24/7 on-demand access to licensed veterinarians

- Less than a 2-minute response time

- Unlimited visits for unlimited pets

Ready for peace of mind with your pets? Go ahead and sign up.